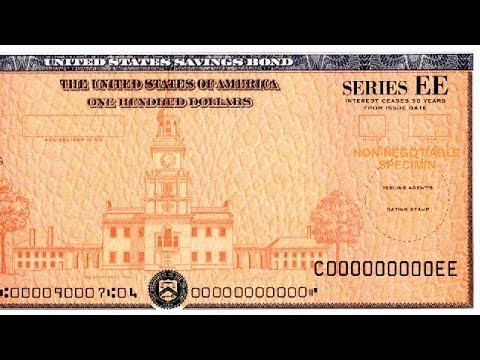

Department of Treasury issues savings bonds with a unique serial number that's used to track the bond's owner and value. As of 2012, there are 14 different types of savings bonds. The most common -- several of which no longer earn interest -- are Series E, EE, H, HH, I and Savings Notes.

TreasuryDirect stopped offering Internet HH/H savings bonds services, including bond look up by serial number, in September 2013. If you have an HH/H savings bond, go to the TreasuryDirect's “Services for HH/H Savings Bonds” page and follow the online instructions to contact a customer service representative for assistance. Aug 25, 2008 - For more information about each type of savings bond, see the Products in. If you had the serial number, the Bureau of the Public Debt could.

1 (a) Serial number (c) Face value 5 Add the amounts in column (c) of line 4. This is your cost of the series I bonds and electronic series EE bonds cashed 5 Total redemption proceeds from the bonds listed in Parts I and II. Be sure to get this figure from the teller when you cash the bonds 6 6 7 Add lines 3 and 5. Serial bond numbers are unique to each savings bond. Each one is issues to a specific person (or people) using their social security number and this is correlated to the savings bond serial number. The saving bond serial number is used to prevent counterfeiting. How to Find Savings Bond Serial Numbers if Bonds Have Been Destroyed. How to Correct Mistakes on Series EE Bonds 2. The Treasury can look up the bond number using this information.

Dear Dr. Don,

I own three Series EE savings bonds with the following purchase dates and face value amounts:

- $500 (June 1983)

- $1,000 (December 1993)

- $500 (May 1994)

When should I cash them in? Do I just take them to my bank and let them cash them?

Are all three at full value as of July 24, 2009?

— Suzanne Savings

Dear Suzanne,

Series EE savings bonds issued in the 1980s and early 1990s have an original maturity of 20 years, and an extended maturity of 10 years, for a total of 30 years until the final maturity of the bonds.

Where Is The Serial Number On Ee Bond

These bonds were purchased at half their face value. Over their original maturities, the bonds increase in value to become worth at least the face amount. During the extended maturity period, the bond continues to earn interest according to the terms of the extension period.

The Series EE bond you own from 1983 will reach its final extended maturity in June 2013. At final maturity, the bond stops earning interest. Deferred interest earnings become taxable when the bond is redeemed or matures.

The TreasuryDirect Web page “When Interest is Added to Your Bonds” explains why, for your bonds, it makes sense to wait until an interest payment month to redeem the savings bond.

The interest rate earned by your bonds for any six-month interest period depends on the terms of the savings bond when purchased. The TreasuryDirect Web page “Before May 1995 (EE Bond Rates and Terms)” explains the different approaches to establishing an interest rate depending on when the savings bonds were purchased and the bond’s current age.

An easy way to get around all the particulars concerning the interest rates on your bonds is to use the Savings Bond Wizard and input the information about the bonds. The Savings Bond Wizard is available as a download on the TreasuryDirect website. I used it for your bonds and came up with the following information:

EE savings bond details | ||||||||

|---|---|---|---|---|---|---|---|---|

| Face value | Issue date | Price | Interest | Value | Rate | Yield | Next interest date | Final maturity date |

| Face value: $500 | Issue date: Jun-83 | Price: $250 | Interest: $764.40 | Value: $1,014.40 | Rate: 1.78% | Yield: 5.46% | Next interest date: Dec-09 | Final maturity date: Jun-13 |

| Face value: $1,000 | Issue date: Dec-93 | Price: $500 | Interest: $449.60 | Value: $949.60 | Rate: 1.32% | Yield: 4.18% | Next interest date: Dec-09 | Final maturity date: Dec-23 |

| Face value: $500 | Issue date: May-94 | Price: $250 | Interest: $214.40 | Value: $464.40 | Rate: 1.70% | Yield: 4.17% | Next interest date: Nov-09 | Final maturity date: May-24 |

| Totals: | Price: $1,000 | Interest: $1428.40 | Value: $2,428.40 | |||||

Alternately, you can just use the savings bond calculator to find out the information without downloading the program. That would allow you to calculate the value as of the July 2009 date. Pay attention to the next accrual (interest) date, however, so you know when the next interest payment is credited to the bond.

Use the rate column to see what you’re currently earning on the savings bonds. The yield column shows the return over the time you’ve owned the bonds. I’d use the rate column, updated to reflect the new rates available to you at the next interest date, to decide whether or not to redeem the bonds.

If you’ve been deferring the income tax due on the interest earnings, the earnings are reported as interest income for the tax year the bonds are redeemed.

The savings bonds purchased in the early 1990s may qualify for the Savings Bonds in Education program. If that’s the case, the interest earnings are excluded from federal income tax when bonds are used to finance education. Restrictions apply — see the “Education Planning” page on the TreasuryDirect website for more information.

Get more news, money-saving tips and expert advice by signing up for a free Bankrate newsletter.

Ask the adviser

To ask a question of Dr. Don, go to the “Ask the Experts” page and select one of these topics: “Financing a home,” “Saving & Investing” or “Money.” Read more Dr. Don columns for additional personal finance advice.

Bankrate’s content, including the guidance of its advice-and-expert columns and this website, is intended only to assist you with financial decisions. The content is broad in scope and does not consider your personal financial situation. Bankrate recommends that you seek the advice of advisers who are fully aware of your individual circumstances before making any final decisions or implementing any financial strategy. Please remember that your use of this website is governed by Bankrate’s Terms of Use.

You may also like

Whether you got them as a birthday gift from Grandma or bought them through a payroll deduction on your first job, you may own U.S. Savings Bonds that have stopped earning interest.

Series EE Bonds, the common variety first issued in 1980 -- and still being issued today -- were designed to pay interest for up to 30 years. So any bonds dated 1989 or earlier – the first generation, so to speak – will have stopped paying by the end of 2019. At that point, their value is frozen, so there is no reason other than nostalgia to hang onto them. Instead, you can cash them in and put the money to more productive use.

Before the advent of Series EE Bonds, Grandma might have bought you a Series E Savings Bond. Those were issued from 1941 to 1980, and all of them have stopped earning interest, too.

The more recent Series I Bonds – the kind that pays a combined fixed and inflation-adjustedrate of interest – were first issued in 1998. They’re good for 30 years, so the earliest of them will stop gaining value in 2028.

How much unclaimed money is out there in the form of savings bonds that have stopped earning interest but have yet to be redeemed? The U.S. Treasury Department estimates that it’s in the billions of dollars.

What Your Bonds Are Worth

To determine the value of your old bonds, you can use the Savings Bond Calculator on the TreasuryDirect website. You’ll just need the type of bond, its denomination, and the date it was issued. There’s also a place to type in your bond’s serial number, but you don’t need that in order to get a value.

The calculator’s answer may pleasantly surprise you. For example, a $50 bond issued in August 1982, for which Grandma would have paid $25, is now worth $146.90. A $100 bond from February 1984 is good for $230.64.

If you believe you own some old savings bonds, but have lost track of them, you may be able file a claim for the bonds with the Treasury, by filling out Fiscal Service Form 1048, Claim for Lost, Stolen, or Destroyed United States Savings Bonds, available with instructions on the website. Unfortunately, the popular online tool Treasury Hunt was discontinued in early 2017.

Finding Bonds In My Name

How to Cash In

You can redeem your old paper bonds at many banks and other financial institutions. The TreasuryDirect website doesn’t maintain a list, but suggests you call around.

Bear in mind that savings-bond interest is subject to federal income tax, though not to state or local tax. You can either report it and pay tax every year that you hold the bond or wait until the end and pay the tax all at once, as most people do. After redeeming your bonds, you’ll receive an IRS Form 1099-INT, reflecting your taxable gain.

An exception, in certain cases, is if you use the proceeds from bonds issued in 1990 or later to pay qualified higher-education expenses for yourself or your child. Those rules, which include income limits, are explained in the Education Planning section of the TreasuryDirect site.

The Bottom Line

Bond Number Lookup

Don't sit on cash that's coming to you. But before you cash in your bonds, it’s a good idea to record what the Savings Bond Calculator says they’re worth, just to be sure you get every dollar you're owed.

Grandma wouldn’t want it any other way.